Previous Article

Fintech Startup — Data Strategy

Summary

A fintech startup wanted to launch in US and European markets via a mobile banking app offering a personalized, data-driven customer experience.

Silicon Valley Data Science developed a launch plan, including the necessary prioritized data sources, architecture, and analytical methods.

Background and Business Problem

Our client, a fintech startup, seeks to provide a more personalized consumer banking experience, compared to existing models. Their product objectives include:

- manage personal expenses, savings, and goals

- provide education and nudges to improve financial awareness

- identify and understand life events that may have financial impact

- establish new metrics aligned to modern consumer needs and behaviors

The client needed to extract insights using data science and machine learning to generate personalized content to help customers achieve their financial goals.

Being a startup made things particularly challenging. They committed a launch date to investors, partners, and consumers, but had none of the essential data to build the product. The underlying mobile app was being designed, and the platform to support it was nonexistent. They had limited experience with data science, and used various partners for backend and frontend architecture, software development, etc.

Our client recognized that data science and engineering were essential to their launch and ongoing success. They sought a partner who could help them address the “cold start” problem (i.e., no data), articulate how to create the models to support their objectives, and make the right architecture investments for their product roadmap.

Solution

While encouraged by investors to work with larger firms providing platforms and broad consulting services, the client chose SVDS because we demystified much of the hype being used in fintech, artificial intelligence, and modern data strategy. Our team connected on why this product was important to the market and aligned on the founders’ mission.

We began by unpacking our client’s business objectives into technical outputs required by the mobile app, as well as those required from the underlying data science. This is a key first step in our data strategy methodology.

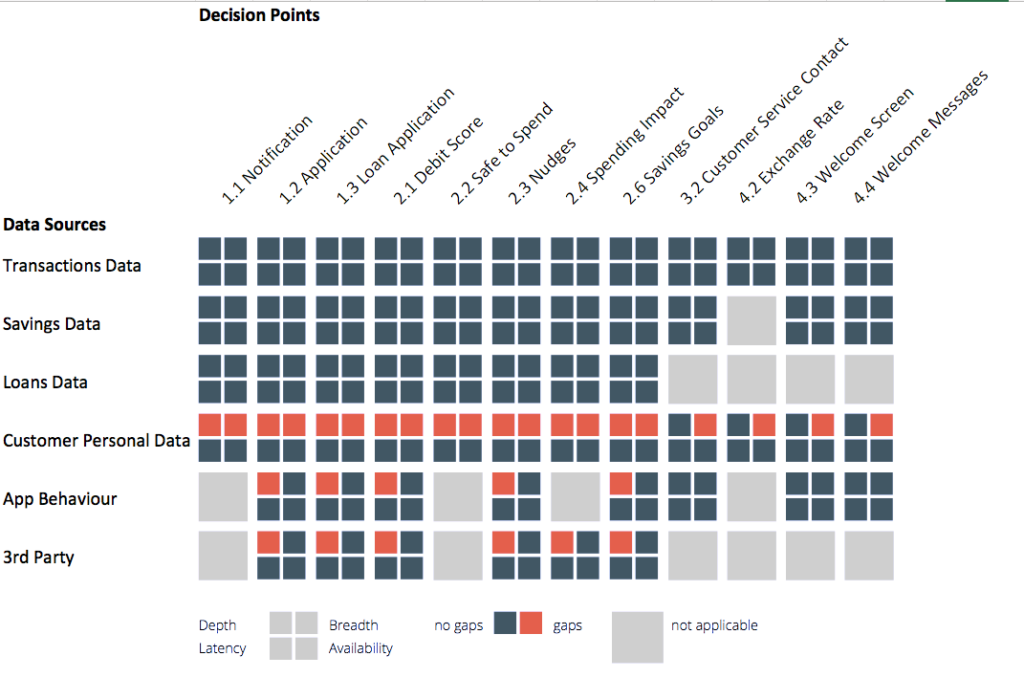

We identified data science approaches that would be feasible in the short term, as well as possible in the long term, post launch, with a critical mass of clients and enough historic transaction data available. We performed a data gap assessment to validate the feasibility of the near term approaches and assessed the impact of the gaps that were identified. We recommended mitigations to these gaps.

We also designed a conceptual architecture that would enable the model lifecycle from development to testing to production, while integrating with the planned architecture conceptualized by the other backend and frontend partners. We provided details on the platform components that would be needed to support the production patterns anticipated with the model approaches we proposed.

Finally, we prepared a very detailed roadmap and project backlog for our client, to accelerate their ability to begin the build process on these critical data science capabilities. In conjunction with this, we realized that, given the aggressive launch timing, getting transaction data to begin testing hypotheses on was vital. We explored options on behalf of the client and found a reasonable data source that could be used.